EGYPT: United Oil & Gas Half-year 2022 results

United Oil & Gas PLC (AIM: “UOG”), the growing oil and gas company with a portfolio of production, development, exploration and appraisal assets is pleased to announce its unaudited financial and operating results for the half year ended 30 June 2022. A shareholder call will take place this morning, details are below.

Brian Larkin, CEO commented:

“The Company’s balance sheet is the strongest it has ever been and in the first half of the year we have continued an active work programme across our portfolio of assets.

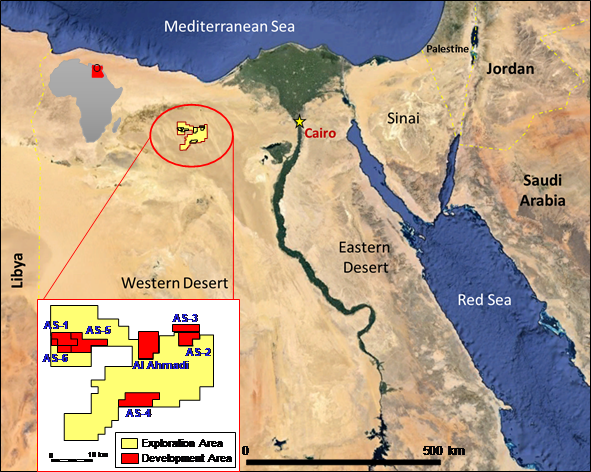

“We look forward to drilling both the ASH-4 development well and ASF-1X exploration well on the Abu Sennan licence by the end of the year. Successful outcomes on these wells have the potential to significantly increase production levels, add reserves, and boost the longer-term value of the Abu Sennan licence.

“United’s portfolio consists of complementary assets that have the potential to provide short, medium and long term upside to all our stakeholders and provides a platform for growth. Abu Sennan in Egypt continues to deliver production and strong cashflows.”

1H 2022 Operational summary

· 1H 2022 Group working interest production averaged 1,552 boepd

· In Egypt

– Active drilling programme continues with three out of five wells in the 2022 programme now drilled

– Successful ASD-2 development well brought onstream in March, just six days after well completion.

– ASV-1X exploration well did not yield commercial volumes, but encountered evidence for the migration of hydrocarbons de-risking this element of the petroleum system in this area of the licence

– AJ-14 development well encountered seven metres of net pay. The operations programme continues with well stimulation expected to deliver production rates in line with pre-drill estimates of c. 300 bopd gross (post period)

– The ASH-4 development well has commenced drilling, targeting over 2 mmbbls gross in the prolific Alam El Bueib reservoir (post period)

– Significant increase in the interpreted in-place volumes on the ASH field following improvement to the subsurface imaging from seismic reprocessing

– Zero – Lost Time Incident Frequency rate and Fatal Accident Frequency rate. No environmental spills, Restricted Work Incidents or Medical Treatment Incidents

1H 2022 Financial summary

· Group revenue for the first half of 2022 was $9.8m(1) (1H 2021:$10.2m)

· Realised oil price of $105.5/bbl (1H 2021:$63.1/bbl)

· Gross Profit (excluding Egypt tax gross up) $5.6m (1H 2021: $5.7m)

· Cash Operating Expenses of $8.40/boe (1H 2021: $4.61/boe)

· Profit After Tax of $2.4m (1H 2021: $2.0m)

· Cash collections in the six-month period of $8.7m (1H 2021: $8.2m)

· Repayments on BP Pre-payment facility of $1.6m (H1 2021: $2.4m)

· Group cash balances at period end were $3.8m (1H 2021: $2.0m)

· Group Cash balance as at 23/9/2022 of $4.7m

Outlook

· The full year 2022 average group working interest production guidance range has narrowed to 1,450 – 1,500 boepd (vs 1,500-1,650 boepd previously guided). This is primarily due to rescheduling of the 2022 drilling programme in order to incorporate the results of seismic reprocessing prior to drilling the high impact ASH-4 development well which has now commenced drilling

· In Egypt, drilling results from ASD-2 and the seismic reprocessing over the ASH field are expected to have a positive impact on year-end reserves

· The drilling programme in Abu Sennan is continuing, and we look forward to completing the ASH-4 development well, targeting 2.2 mmbbls gross recoverable resources from the prolific AEB reservoir and the ASF-1X exploration well with a pre-drill target of c. 8 mmbbls gross recoverable resources

· United continues to evaluate M&A opportunities with a strengthened balance sheet to support the growth strategy